What are the forums for trading gold futures? This means that actual physical metal never changes hands. For this reason, the vast majority of contracts are usually closed out well prior to the delivery date. Generally, futures contracts will be settled in cash everyday and are very liquid. With gold futures, investors can purchase contracts on margin, and this means that investors only need to deposit a small fraction of the value of the contract in cash in order to take that position.

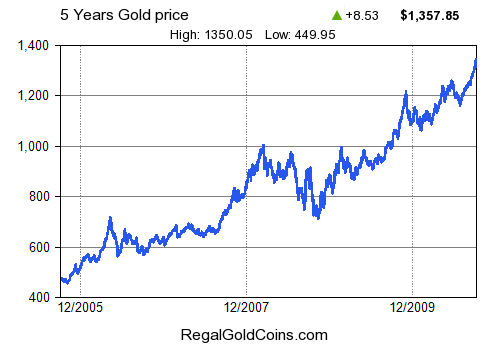

They are also used by investors that are out to grab large positions in gold market and who do not want to lock up so much capital. Typically, futures are used by bullion dealers interested in hedging their physical positions. The terms gold futures refer to contracts that allow a buyer as well as a seller to agree to trade a specific quantity of gold bullion in future at a particular date. Generally, a product is more liquid if the spread is tighter. Bid-ask spread I a term used to mean the difference between Bid and Ask prices. In case you are buying, you will be required to pay Ask price but where you are selling, you will get the Bid. What do the words Bid and Ask Prices mean?īid price is a term used to show the current highest offer to purchase in the market while ask price is the current lowest offer to dispose of in the market. This guarantees that at all times, our spot prices are very accurate. We make use of up to the second data feed powered by. Other factors that influence the spot price of gold are political events, investor sentiments, macroeconomic events and economic data releases. Gold spot price fluctuates depending on various factors and these include supply and demand not only in physical but also in futures markets. Note that each weekday, the markets will close from 5:15PM all the way to 6 PM EST. The gold spot may be determined by various domestic as well as foreign exchanges, which allow the spot price to adjust from 6PM EST all the way to 5:15 PM EST, from Sunday to Friday.

In fact, it can change throughout the day and is influenced by supply and demand, breaking news as well as other macroeconomic factors. The spot price of gold fluctuates every few seconds in the course of marketing hours. How frequently does the price of gold change? Although some people like the ease of purchasing paper gold, others insist on seeing and holding the precious metal. It is not like owning gold bullion since you don’t actually take physical possession of the gold. A gold certificate can be defined as merely a piece of paper that states that you own gold in a specified amount stored at a particular offsite location. Investing in gold an also be through purchasing gold certificates. Physical gold, like most precious metals, is seen by many people as the best way to shield themselves from fluctuation of the stock market and devaluation of paper currency.

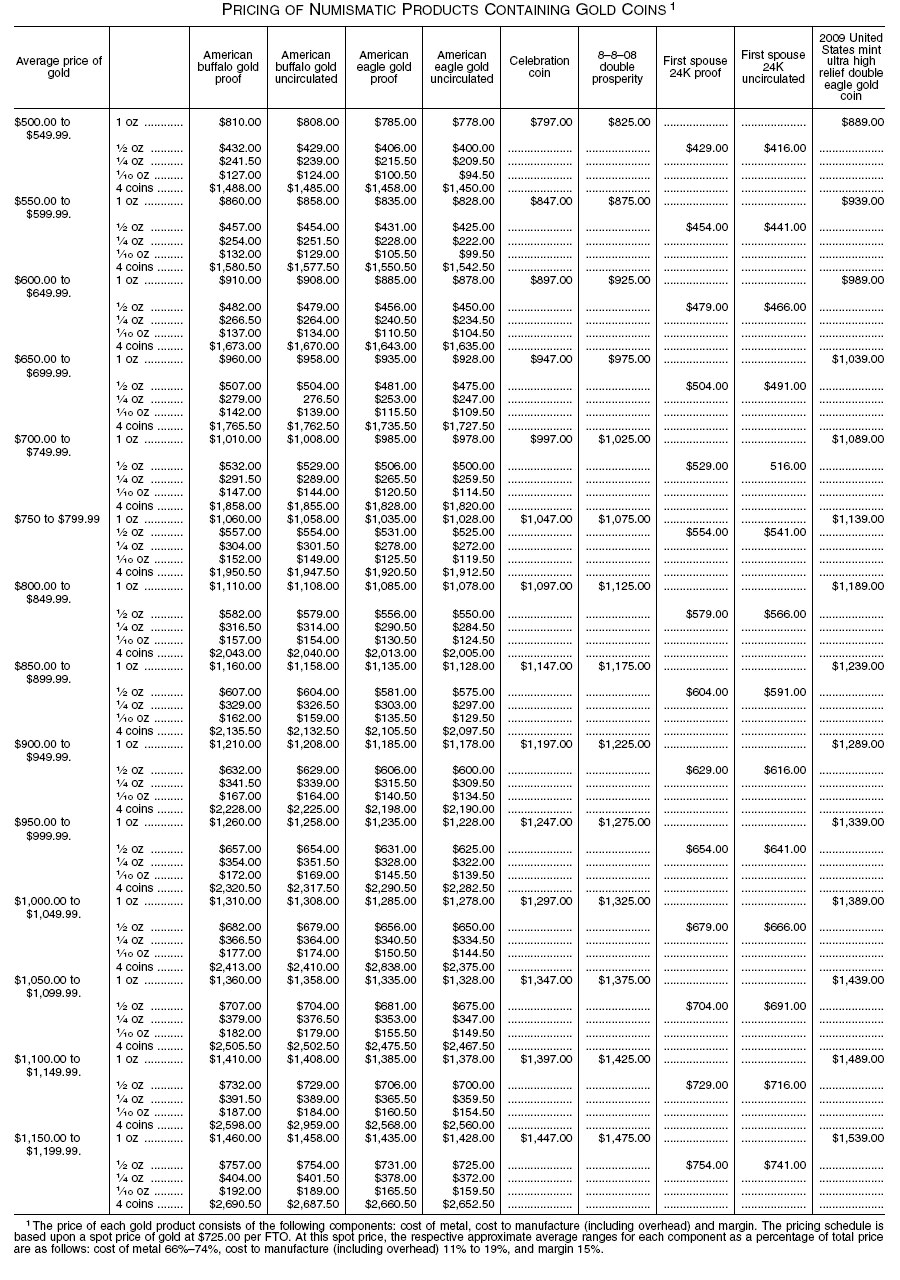

The physical gold is most likely to be found in the forms of coins, bars as well as round form and several sizes occur for each form.įor gold bars, the sizes range from one gram to 400 ounces while for coins, the sizes tend to range from one ounce to fractional sizes.

This is in the US and also throughout the world. Physical gold is produced by government mints and private companies. You can invest in gold either in bullion or paper certificate forms. The prices are normally set in troy ounces and will change in few seconds in the course of market hours. The spot price of gold forms the basis of determining the exact price of a gold bar or coin. This price is often driven by a number of factors and these include market speculations, current events, currency values and several other factors. The gold spot price is the most widespread standard used for gauging the going price for one ounce of gold.

0 kommentar(er)

0 kommentar(er)